unified estate and gift tax credit 2020

ESTATE AND GIFT TAXES Estate Taxes 2021 2020 Estate tax exemption 11700000 11580000 Unified estate tax credit 4577800 4577800 Top estate tax rate 40 40 Gift Taxes 2021 2020 Lifetime gift tax exemption 11700000 11580000 Annual gift tax exclusion. The IRS refers to this as a unified credit Each donor the person making the gift has a separate lifetime exemption that can be used before any out-of-pocket gift tax is due.

It consists of an accounting of everything you own or have certain interests in at the date of death.

. This is called the unified credit. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is. For 2021 the estate and gift tax exemption stands at 117 million per person.

The Internal Revenue Service announced today the official estate and gift tax limits for 2020. Get Your Max Refund Today. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit.

In other words use it or lose it. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. The estate tax is a tax on your right to transfer property at your death.

The Unified Tax Credit represents the amount of assets that an individual is allowed to gift to other parties without having to pay gift estate or generation-skipping transfer taxes. Estate Planning 2017 2018 2019 2020 Annual Gift Tax Exclusion 14000 15000 15000 15000 Annual Gift Tax Exclusion to a Noncitizen Spouse 149000 152000 155000 157000 Applicable Exclusion Amount. In addition to the unified tax credit individuals can give up to 15000 a year to a recipient or recipients 15000 per gift to as many recipients regardless of how many people you gift and not have to pay a gift tax.

In 2020 after adjustment for inflation it was raised to 1158 million for individuals and 2316 million for a married couple. Special transfer tax credits exemptions and deductions Unified credit. Estate and Gift Taxes.

The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate tax. Gifts and estate transfers that exceed 1206 million are subject to tax. The unified tax credit gives a set dollar amount that an individual can gift during their lifetime and pass on to heirs before any gift or.

Heres a look at the federal estate taxgift tax exemption over. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed.

Find some of the more common questions dealing with basic estate tax issues. Then there is the exemption for gifts and estate taxes. That number is used to calculate the size of the credit against estate tax.

What is the gift amount for 2020. Additionally in 10 years the gift and estate tax exemption will have likely reverted back to the lower 549 million amount for dates after 2025. The unified tax credit is designed to decrease the tax bill of the individual or estate.

Gift Tax 5490000 11180000 11400000 11580000 Estate Tax 5490000 11180000 11400000 11580000 Applicable Credit Amount. The previous limit for 2020 was 1158 million. As of 2021 married couples can exempt 234 million In 2022 couples can exempt 2412 million.

The IRS announced new estate and gift tax limits for 2021 during the fall of 2020. For 2020 US residents and citizens are entitled to a US estate tax unified credit of approximately 4577800 which essentially exempts 1158 million of property from estate tax. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of 55 to a n.

For 2020 US residents and citizens are entitled to a US estate tax unified credit of approximately 4577800 which essentially exempts 1158 million of property from estate tax. The estate and gift tax exemption is. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

A key component of this exclusion is the basic exclusion amount BEA. The lifetime gift tax exclusion in 2020 is 1158 million meaning the federal tax law applies the estate tax to any. The unified credit is per person but a married couple can combine their exemptions.

15000 In 2020 and 2021 you can give up to 15000 to someone in a year and generally not have to deal with the IRS about it. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure. Any tax due is determined after applying a credit based on an applicable exclusion amount.

Learn about the COVID-19 relief provisions for Estate Gift. This credit is significant as amounts above this level will be taxed at rates starting at 18 and gradually increasing to 40 as of 2020 based on the size of the estate. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit.

The basic exclusion amount for determining the unified credit against the estate tax will be 11580000 for decedents dying in calendar year 2020 up from 11400000 in 2019. For 2021 that lifetime exemption amount is 117 million. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

The unified tax credit is designed to decrease the tax bill of the individual or estate. Gift and Estate Tax Exemptions The Unified Credit. The lifetime gift tax exclusion was expanded under the Tax Cuts and Jobs Act and with an inflation adjustment in 2020.

For 2020 estate tax rates start at 18 and reach 40 for assets worth more than 1 million. Oct 27 2020 Unified Credit Against Estate Tax.

Personal Planning Strategies December 2021 Proskauer Rose Llp Jdsupra

Irs 2021 Tax Rates Announced Msl Cpas Advisors

Irs 2021 Tax Rates Announced Msl Cpas Advisors

Deceased Spousal Unused Exclusion Dsue Portability

Understanding Qualified Domestic Trusts And Portability

Irs 2021 Tax Rates Announced Msl Cpas Advisors

What Is The 2021 Vermont State Estate Tax Exclusion Vermont Estate Planning Attorneys

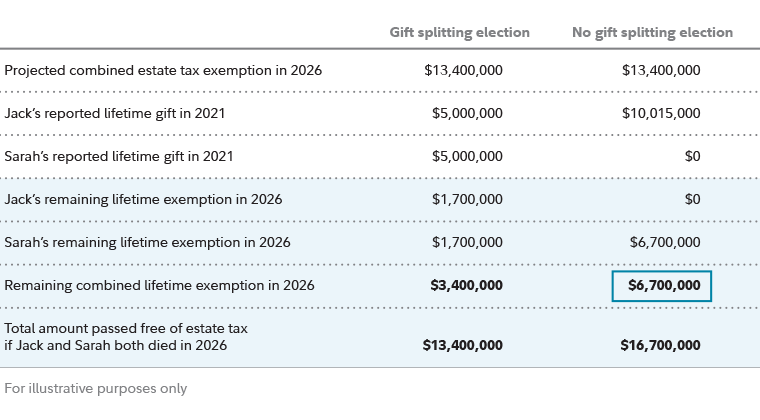

Estate Planning Strategies For Gift Splitting Fidelity

Estate Planning Strategies For Gift Splitting Fidelity

Federal Estate Tax Returns 1998 2000 Document Gale Academic Onefile

Irs 2021 Tax Rates Announced Msl Cpas Advisors

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

Qualified Domestic Trusts And Portability Palisades Hudson Financial Group

Utilizing The Annual Gift Tax Exclusion Mize Cpas Inc

Irs 2021 Tax Rates Announced Msl Cpas Advisors